Studying Montreal’s Financialization of Multi-Family Rental Housing

Spatiality, local specificity and empirical methodology

Last modified:

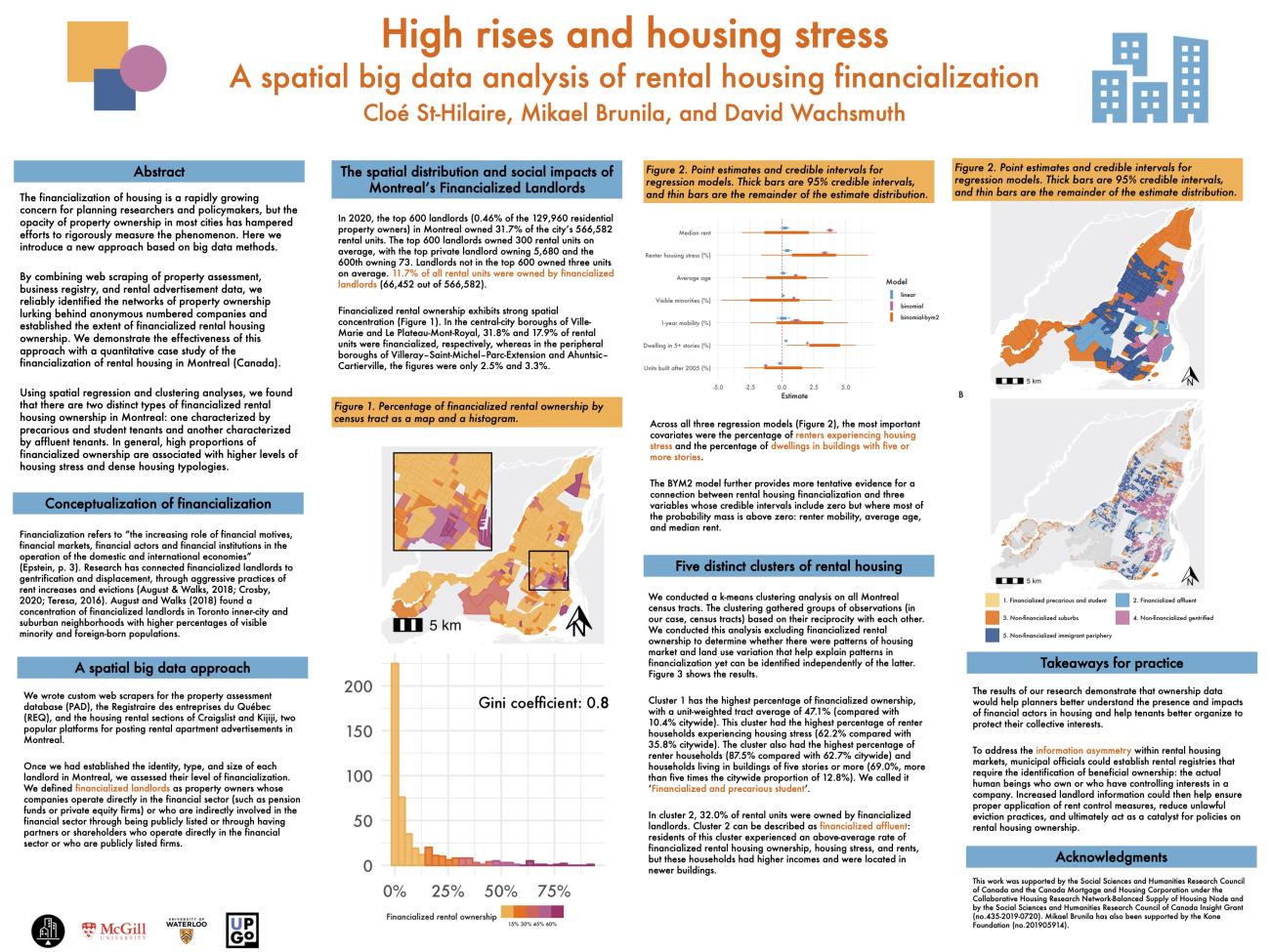

This study will inform policy on the impacts of financialized landlords in Montreal. Second, this research aims at providing a methodological framework for empirically studying financialization within a given geography.

Jump to Research OutputsWho own’s Montreal’s rental stock?

This study will inform policy on the impacts of financialized landlords in Montreal. Second, this research aims at providing a methodological framework for empirically studying financialization within a given geography. Combining datasets of Montreal’s landlords, property assessment and census data, the study will equip researchers with empirical processes for studying financialization on a larger scope. Currently, methods for studying financialization are either focused on certain financial players, such as REITs or pension funds (August 2020; Garcia-Lamarca 2020); on a slice of the housing sector, such as housing production (Romainville 2017); or on specific buildings or types of buildings (Fields 2017; Fields 2015). Through an open-source process, this study will make available a reproducible framework for analyzing and quantifying the presence and impacts of financialized landlords in a city.

Project Lead(s):

Home Organization:

McGill University

Other Participants:

Community Partner:

Regroupement des comités de logements et associations de locataires du Québec

Funding Stream:

Community-Focused Project

Project Status:

Complete

Goals

The goal of this research is two-fold. First, it aims at creating a portrait of the financialization of Montreal’s multi-family rental housing sector by looking at the ownership evolution and type, the economic geography of financialized landlords in the City, and highlighting the local specificities of Montreal’s rental financialization; thus enabling potential future comparative research with other Canadian cities. Current studies focusing on the financialization of rental housing in Canada are limited in geographies (August 2020; August and Walks 2018; Crosby 2020), and no exhaustive portrait of the dynamics of financialization in a Quebec metropolis currently exists (see Gaudreau 2020 for an analysis of financialized housing production in two of Montreal’s boroughs). This research will combine a literature review on financialization and a discourse analysis of Montreal’s financial actors to provide information on the strategy of the latter in the City’s rental housing market. It will utilize data to map the economic geography of financialized landlords in the city and quantify their presence.

Research Outputs

Existing reports, presentation materials, podcasts, webinar recordings, and research summaries.

Alert the presses!

This project hasn’t hit the news yet.